RJO Futures

Don't think you know, be sure you know!

On Demand Webinar Series

No video selected

Select a video type in the sidebar.

Below are all of our Available Webinars

Introduction to Options

Basics of Breakout Trading

If you’re a futures trader, that’s a mantra that should serve you well when it comes to trading breakouts. The earlier you can identify a legitimate price trend and enter a position, the greater the potential return on your trades.

If you’re somewhat new to futures trading, however, this is often easier said than done...

Futures Trading Strategies

Yield Curve and its Relation to Recession

In past recessions, the yield curve has turned negative, or inverted roughly 2-3 years before a recession, or at least the recognition of one. Often times an economy can be in a recession before it is even recognized. Historically, the yield curve has been a pretty accurate predictor of an impending recession, but it is not the end-all-be-all. Sometimes, rates may rise one more time before...

Seven Steps to a Better Trading Psychology

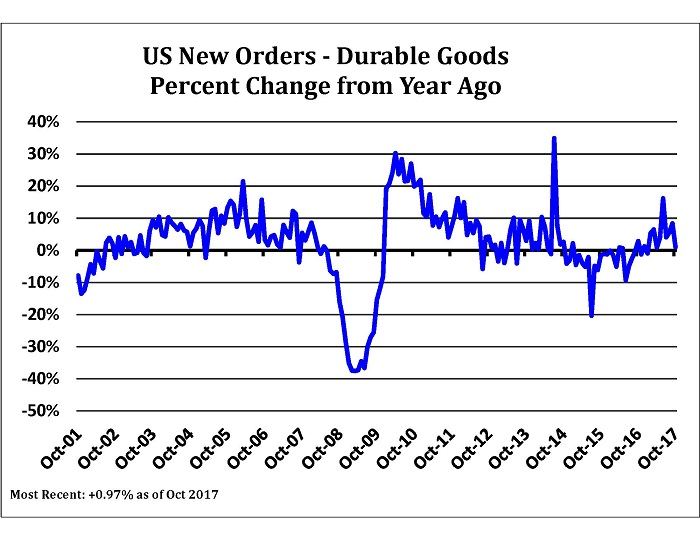

Durable vs. Non-Durable Goods, what's the Difference

Durable Goods Orders are an economic indicator released monthly by the Census Bureau. It reflects new orders placed with domestic manufacturers for the delivery of factory hard goods. A hard good is a good that does not quickly wear out. It yields utility over time instead of being consumed in...

Trading Volatility with Options

Scalping the Market

Scalping the market is a trading technique in which a trader attempts to profit from short-term price changes intra-day. It tends to work best in a choppy market that is not trending in one direction only. Even if the overall trend of that market is up or down, you can benefit from both directions when you scalp. The best markets to scalp are...

Trading Opportunities for Busy People

Factors behind Interest Rate Changes

Most investors and traders care about future interest rates, but none more than traders of stock index futures, interest rate futures, and currency futures. If you are considering a trade in any of these markets, you must ask yourself, “Do I think interest rates will rise in the future?” If the answer is “yes” then...

Trading Equity Futures

Fibonacci Retracement Trading

Fibonacci retracement trading a popular technical tool used by traders to determine price action. Fibonacci retracement trading is taking two extreme points from a contract’s price, usually a high and a low, then dividing it by a Fibonacci ratio to determining support and resistance levels...

Trading Metal Futures

Basics of Technical Analysis

For beginning investors, technical analysis may seem somewhat daunting, given the specialized terminology and chart analysis that’s involved.

The truth, however, is that virtually anyone can master the basics of technical analysis in a reasonably short time, adding a powerful new tool to their trading repertoire...

Trading Agricultural Futures

Candlestick Chart Basics

Candlestick charts are charts used by traders to try and determine potential price movements based on historic patterns. A Japanese rice trader is considered by many to be the godfather of technical analysis and candlestick charts. In his book, “The Fountain of God” in 1755, he figured out that...

Trading Currency Futures

Pivot Point Trading

Many markets will experience heightened market volatility, created by market uncertainty. In this environment, many traders find themselves getting chopped up by the violent fluctuations and then becoming reluctant to get back in. One strategy to use when dealing with

Resourceful Trader part 1

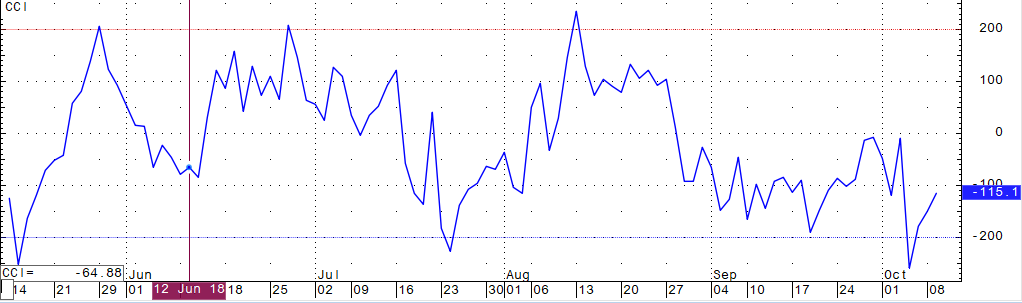

Commodity Channel Index

First developed by Donald Lambert, the Commodity Channel Index, or CCI, is a technical trading tool that measures the momentum of a certain investment to help determine if that investment is in danger of being overbought or oversold. In a more technical...